Enter Berachain: a high-performance, EVM-compatible blockchain that is set to redefine the landscape of decentralized applications (dApps) and blockchain services. Built on the innovative Proof-of-Liquidity consensus and leveraging the robust Polaris framework alongside the CometBFT consensus engine, Berachain is poised to offer an unprecedented blend of efficiency, security, and user-centric benefits. Let's dive into what makes it a groundbreaking development in the blockchain ecosystem.

What is Berachain?

Overview

Berachain is an EVM-compatible Layer 1 (L1) blockchain that stands out through its adoption of the Proof-of-Liquidity (PoL) consensus mechanism. Designed to address the critical challenges faced by decentralized networks. It introduces a cutting-edge approach to blockchain governance and operations.

Key Features

- High-performance Capabilities. Berachain is engineered for speed and scalability, catering to the growing demand for efficient blockchain solutions.

- EVM Compatibility. It supports all Ethereum tooling, operations, and smart contract languages, making it a seamless transition for developers and projects from the Ethereum ecosystem.

- Proof-of-Liquidity.This novel consensus mechanism focuses on building liquidity, decentralizing stake, and aligning the interests of validators and protocol developers.

MUST READ: Docs

EVM-Compatible vs EVM-Equivalent

EVM-Compatible

EVM compatibility means a blockchain can interact with Ethereum's ecosystem to some extent. It can interact supporting its smart contracts and tools but not replicating the entire EVM environment.

EVM-Equivalent

An EVM-equivalent blockchain, on the other hand, aims to fully replicate Ethereum's environment. It ensures complete compatibility and a smooth transition for developers and users alike.

Berachain's Position

Berachain can be considered an "EVM-equivalent-plus" blockchain. It supports all Ethereum operations, tooling, and additional functionalities that optimize for its unique Proof-of-Liquidity and abstracted use cases.

Berachain Modular First Approach

At the heart of Berachain's development philosophy is the Polaris EVM framework. It's a testament to the blockchain's commitment to modularity and flexibility. This approach allows for the easy separation of the EVM runtime layer, ensuring that Berachain can adapt and evolve without compromising on performance or security.

Proof Of Liquidity Overview

High-Level Model Objectives

- Systemically Build Liquidity. By enhancing trading efficiency, price stability, and network growth, Berachain aims to foster a thriving ecosystem of decentralized applications.

- Solve Stake Centralization. The PoL consensus works to distribute stake more evenly across the network, preventing monopolization and ensuring a decentralized, secure blockchain.

- Align Protocols and Validators. Berachain encourages a symbiotic relationship between validators and the broader protocol ecosystem.

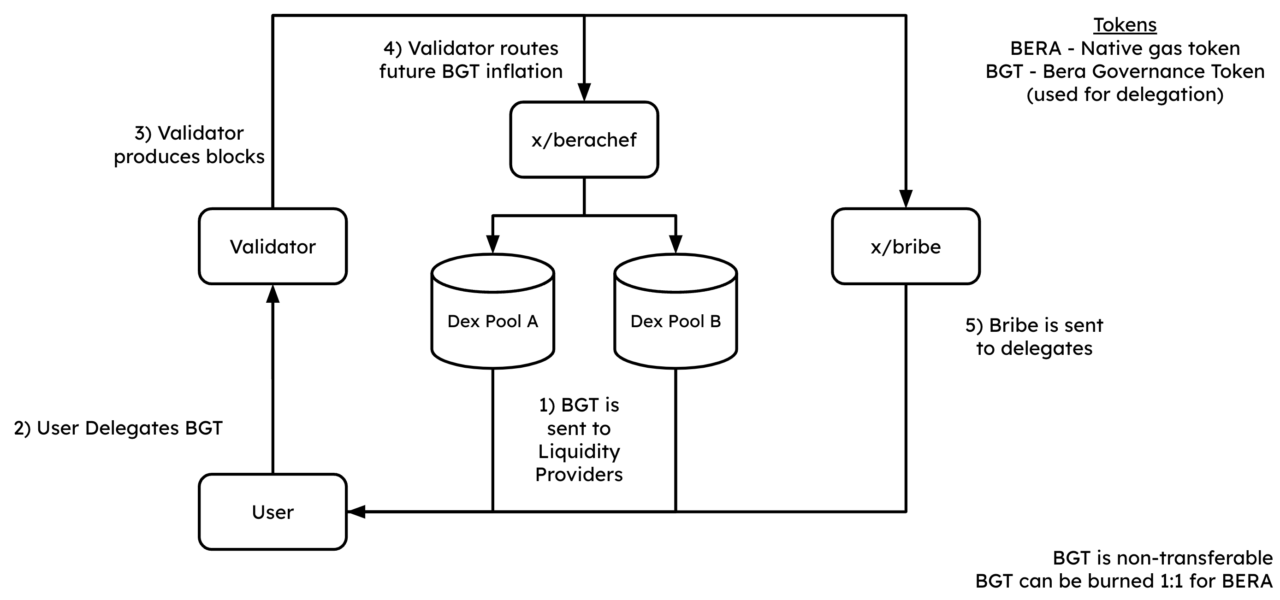

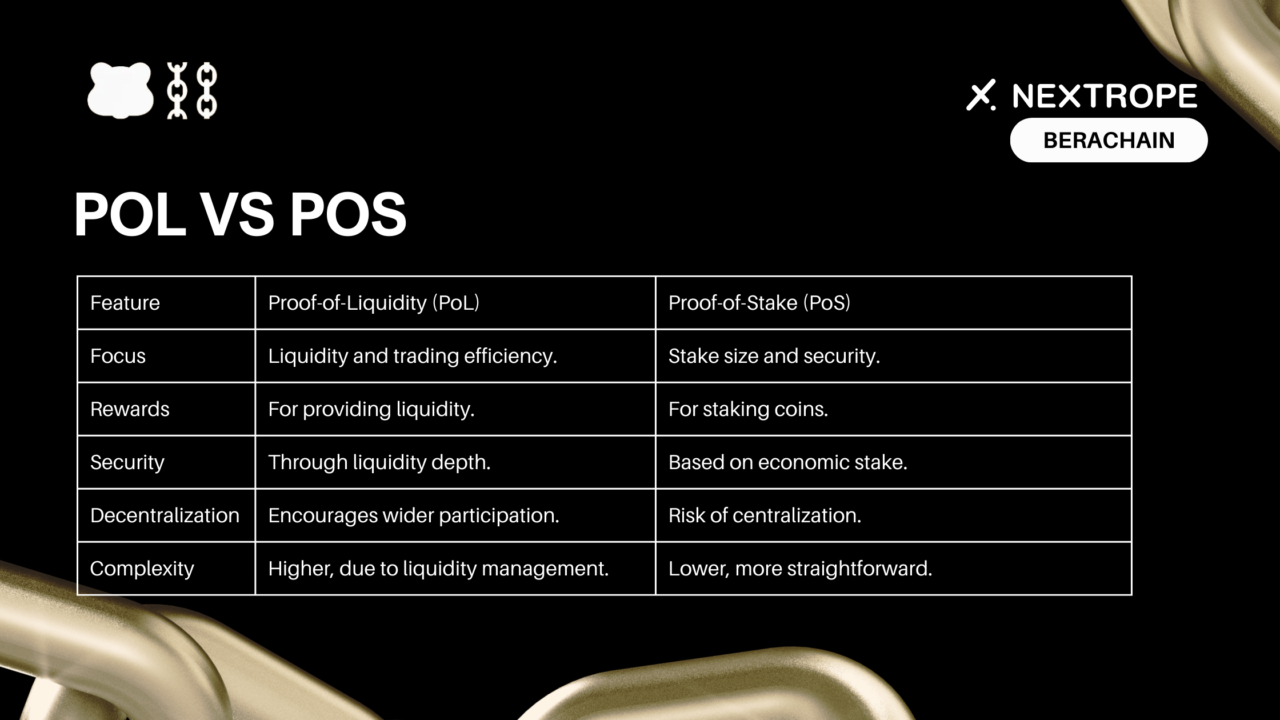

Proof-of-Liquidity vs Proof-of-Stake

Unlike traditional Proof of Stake (PoS), which often leads to stake centralization and reduced liquidity, Proof of Liquidity (PoL) introduces mechanisms to incentivize liquidity provision and ensure a fairer, more decentralized network. Berachain separates the governance token (BGT) from the chain's gas token (BERA) and incentives liquidity through BEX pools. Berachain's PoL aims to overcome the limitations of PoS, fostering a more secure and user-centric blockchain.

Berachain EVM and Modular Approach

Polaris EVM

Polaris EVM is the cornerstone of Berachain's EVM compatibility, offering developers an enhanced environment for smart contract execution that includes stateful precompiles and custom modules. This framework ensures that Berachain not only meets but exceeds the capabilities of the traditional Ethereum Virtual Machine.

CometBFT

The CometBFT consensus engine underpins Berachain's network, providing a secure and efficient mechanism for transaction verification and block production. By leveraging the principles of Byzantine fault tolerance (BFT), CometBFT ensures the integrity and resilience of the Berachain blockchain.

Conclusion

Berachain represents a significant leap forward in blockchain technology, combining the best of Ethereum's ecosystem with innovative consensus mechanisms and a modular development approach. As the blockchain landscape continues to evolve, Berachain stands out as a promising platform for developers, users, and validators alike, offering a scalable, efficient, and inclusive environment for decentralized applications and services.

Resources

For those interested in exploring further, a wealth of resources is available, including the Berachain documentation, GitHub repository, and community forums. It offers a compelling vision for the future of blockchain technology, marked by efficiency, security, and community-driven innovation.

FAQ

How is Berachain different?

- It integrates Proof-of-Liquidity to address stake centralization and enhance liquidity, setting it apart from other blockchains.

Is Berachain EVM-compatible?

- Yes, it supports Ethereum's tooling and smart contract languages, facilitating easy migration of dApps.

Can it handle high transaction volumes?

- Yes, thanks to the Polaris framework and CometBFT consensus engine, it's built for scalability and high throughput.

en

en  pl

pl