The landscape of blockchain and cryptocurrency is continually evolving, marked by the relentless pursuit of models that not only enhance network security and decentralization but also deepen user engagement and ownership. At the heart of this evolution lies the concept of token distribution, a pivotal strategy that can transform users from passive participants into active stakeholders and owners within digital ecosystems. Token distribution is not merely about allocating digital assets; it's about creating a framework where each token serves as a beacon of ownership, rights, and incentives, aligning the interests of users with the long-term success of the platform.

As we delve into the world of token distribution, we find ourselves tracing the path of its evolution. From the foundational Proof of Work mechanisms, to the speculative fervor of ICOs, and onto the community-centric airdrops. Each era has brought with it lessons, challenges, and a deeper understanding of what it means to distribute ownership.

New trend

However, the journey has not been without its pitfalls. Many strategies, while successful in bootstrapping networks and attracting initial interest, have struggled to foster genuine user engagement or have inadvertently encouraged speculative behaviors that detract from the project's core value proposition. It's within this context that we explore the concept of "Progressive Ownership"—a model that aims to refine the token distribution process into a more nuanced, loyalty-driven approach that rewards true product-market fit and user commitment.

The Evolution of Token Distribution Models

The concept of token distribution has undergone significant transformation since the inception of blockchain technology. Each era has introduced new mechanisms for distributing tokens and lowering barriers to entry, while also revealing unique challenges. Let’s explore these pivotal stages in the evolution of token distribution models.

Proof of Work (2009–present): The Dawn of Hardware Formation

The journey began with Bitcoin, which introduced the world to the Proof of Work (PoW) model. This approach allowed anyone with computational resources to participate in network security operations, known as "mining," in exchange for tokens. This mechanism not only secured the network but also democratized access to token ownership. However, as the sector matured, mining became increasingly professionalized, requiring significant investments in specialized hardware. This shift heightened the barriers to entry, gradually sidelining the average user and emphasizing the need for substantial upfront investment. This altered the initial egalitarian vision.

ICOs (2014–2018): The Era of Capital Formation

Following the PoW era, the cryptocurrency space witnessed the rise of Initial Coin Offerings (ICOs). This period came with a new model where projects could raise capital by selling tokens directly to the public. This approach theoretically democratized investment opportunities, allowing projects to reach a broader audience beyond traditional venture capital avenues. Ethereum's ICO in 2014 stood as a landmark event, inspiring a wave of similar endeavors. However, the ICO craze also attracted numerous fraudulent schemes, leading to a regulatory crackdown and a reevaluation of this model,

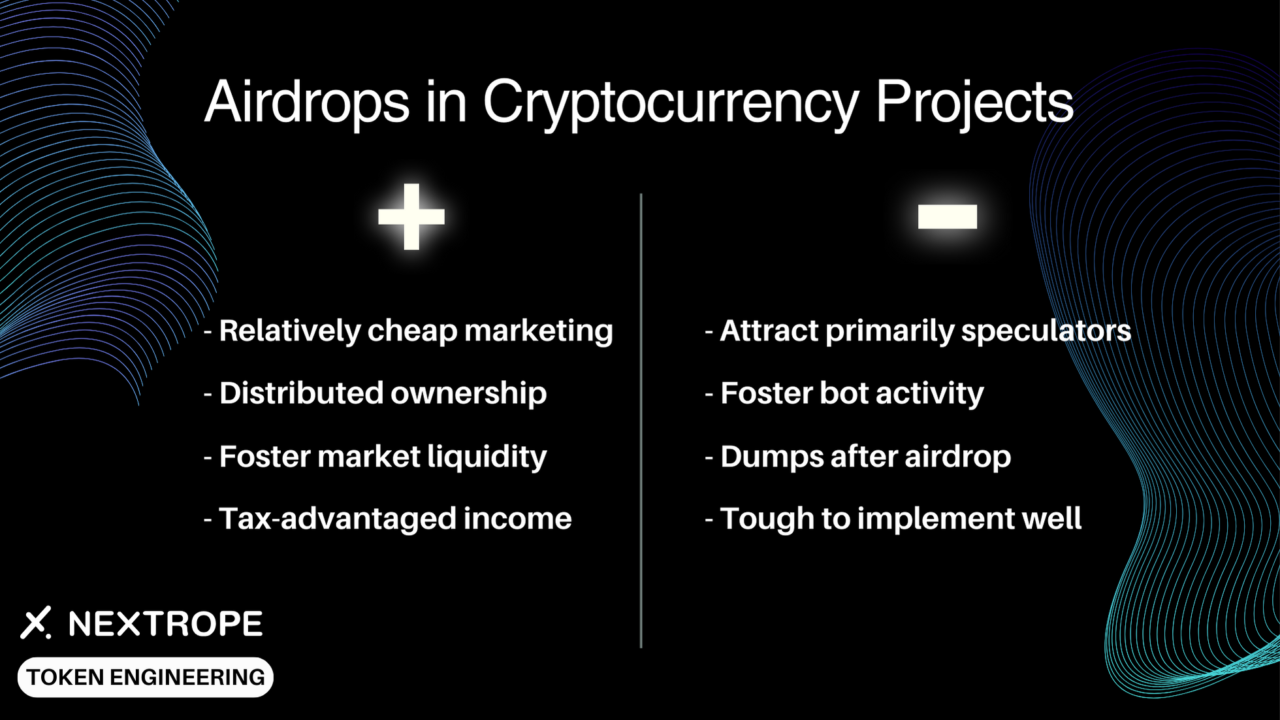

Airdrops (2020–present): Bootstrapping Usage through Community Engagement

In response to the pitfalls of ICOs, the industry shifted towards a more user-centric model: airdrops. This approach involved distributing tokens freely to existing communities or users based on their engagement or historical usage. In principle this fosters a sense of ownership and participation without a direct financial investment. The era of airdrops, particularly during the "DeFi Summer" of 2020, sought to catalyze network usage and decentralization. However, the emphasis on broad, indiscriminate distribution often attracted short-term speculators rather than committed users. This complicates efforts to achieve sustained growth and genuine community development.

Reflections on the Evolution

Each era of token distribution has contributed to the blockchain landscape's growth, expanding access and participation in unique ways. From the hardware-intensive commitments of PoW, through the speculative enthusiasm of ICOs, to the community-focused aspirations of airdrops. The evolution of token distribution models reflects the cryptocurrency sector's dynamics to balance inclusivity, security, and sustainable development. Yet, as we've learned, each model comes with its set of challenges, highlighting the need for continuous innovation. New token distribution strategies come up to foster genuine user ownership and engagement in the ever-evolving digital ecosystem.

Progressive Ownership: A New Frontier

Amidst the evolution of token distribution models, with each era bringing its blend of innovation and challenge, the concept of "Progressive Ownership" emerges. This is a transformative approach aimed at realigning the incentives of blockchain applications and their users. This novel framework represents a significant pivot from previous models, focusing on nurturing genuine user engagement.

Foundation of Progressive Ownership

Progressive ownership stands on the idea that tokens should be distributed to users progressively for their contributions to the network. This model asserts that achieving product-market fit remains paramount and that token distribution should complement, not precede this fit.

In the realm of progressive ownership, tokens become a means to deepen users' commitment to an application. They transform active users into stakeholders with a vested interest in the platform's success. This approach aims to move beyond the shortcomings of indiscriminate airdrops and speculative ICOs. It proposes a more sustainable method of community building.

Key Principles and Advantages

- Incremental Engagement: Progressive ownership advocates for rewarding users in stages, reflecting their growing engagement and value to the ecosystem. This method encourages long-term participation and deters speculative behavior by closely aligning token incentives with genuine user activity and contributions.

- Opt-in Ownership: Central to this model is the concept of opt-in ownership, where users have the choice to convert their earned incentives or revenue shares into tokens representing a more profound stake in the project. This voluntary transition from user to owner ensures that tokens are held by those most aligned with the project's long-term vision and success.

Implementing Progressive Ownership

Successful implementation of progressive ownership requires careful planning and a deep understanding of user behavior and incentives. Projects must first establish a clear value proposition and product-market fit, creating an ecosystem where users’ contributions are quantifiable and rewardable. Following this, a transparent and accessible mechanism for transitioning users from passive beneficiaries of revenue share to active token holders must be established, ensuring clarity around the benefits and responsibilities of ownership.

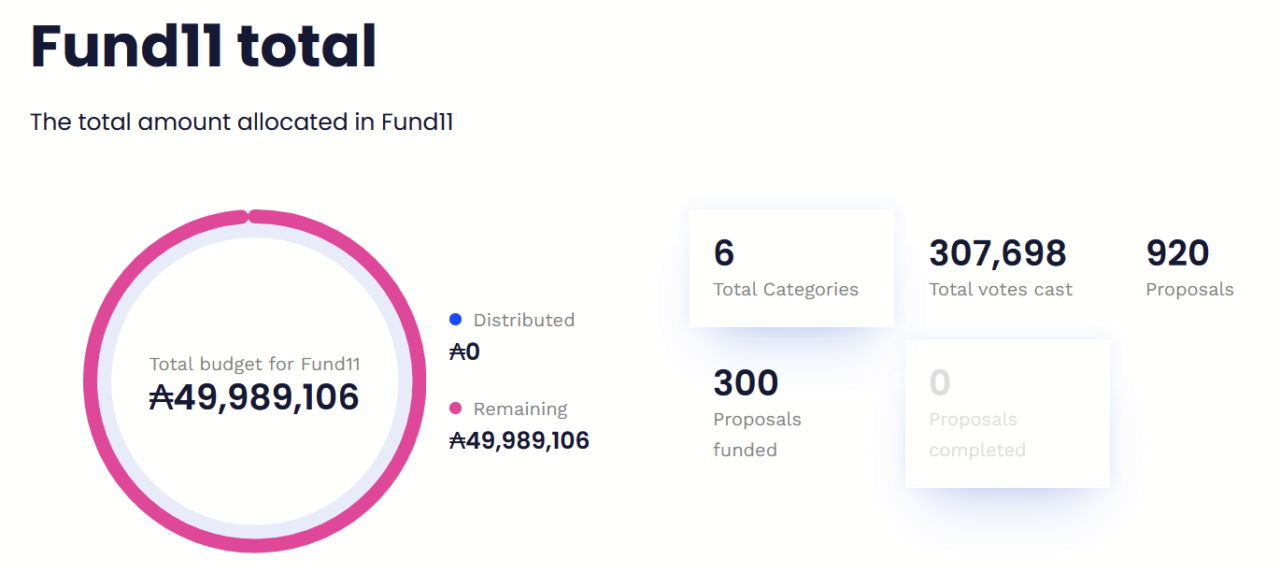

Example Implementation - Project Catalyst

Project Catalyst is a Cardano-based initiative. It’s a decentralized funding mechanism that invites community members to propose projects, which are then voted on by ADA holders. Successful proposals receive funding in ADA, with over $79 million allocated to fund more than 1600 projects by March 2024. This process not only democratizes innovation within the Cardano ecosystem but also aligns with the principles of progressive ownership by giving token holders a vested interest in the network's growth and success. Through Project Catalyst, Cardano effectively engages its community in governance and decision-making, fostering a deeper sense of ownership and participation among ADA holders.

Conclusion

By aligning token incentives with genuine user engagement projects can pave the way for more sustainable development. Such an approach not only deepens user loyalty and retention but also fosters a more vibrant, participatory community. This is the groundwork for the next generation of Champions that will spread the knowledge about your platform.

If you're looking for ways to foster the adoption of your DeFi project, please reach out to contact@nextrope.com. Our team is ready to help you create a strategy that will grow your user base and ensure long-term growth.

FAQ

How to go about designing token distribution in practice?

- It's a good idea to take inspiration from projects similar to yours, which succeded in terms of fostering progressive ownership.

Are airdrops effective?

- Yes. Despite all their shortcomings, if implemented correctly airdrops can do great for marketing purposes for relatively low cost.

Why is fostering an ownership-based culture important?

- Because if your users feel like they partially own the project, then they will contribute to the development process, and share that project with all their friends.

en

en  pl

pl