Have you been hearing about Decentralized Finance and wondered what it really is? Why has it become so popular? On our Nextrope blog, we break down the technology to decipher its constituents and understand what makes it tick. We compare it to Centralized Finance (the current status quo) and see how it holds up.

Why fix something not broken – Centralized Finance vs Decentralized Finance?

Humans have always had a centralized authority directing and regulating the way they earn and spend money. The norm is that a central mint prints and distributes money, the central bank lends to other banks who then lend to their customers, and these customers deposit their savings back into the banks. It has worked for hundreds of years. Why then do we feel like we need an alternative? Why is Decentralized Finance (DeFi) trending? The simple answer is that Centralized Finance (CeFi) has always had glaring problems, but most chose to ignore it since there was no other alternative at hand. With the introduction of distributed ledger technology (blockchain), this is no longer the case. Decentralized Finance has finally become a reality, albeit with drawbacks of its own.

Whenever power, especially financial power, is centralized, most people get locked out of the decision-making process. Consequently, only a small portion of the population reap the benefits of the financial system while the rest are charged exorbitant fees, high interest rates and low returns. Even in the US, only 7% of the bottom 80% of society own shares in companies, whereas in other nations, most do not even have access to stock markets. Currently, transferring money outside of the country involves countless middlemen and substantial fees, obtaining a loan is met with walls of red tape and bureaucracy and the interest rates on deposits is often abysmal.

Even the safety factor that was attributed to banks eroded after the 2008 housing bubble. 2008 showed us that when few control all the money, risk accumulates at the center and endangers the entire system. In addition, banks use money in ways that most people don’t understand. In times of emergency, bank runs (many clients withdrawing their money from a bank) can quickly lead to zero cash balances, as seen in places like Argentina, Venezuela and Zimbabwe.

Is it surprising then that Bitcoin was first launched in 2009, a year after the financial crisis? There was a dire need for the first-ever solution to have global peer-to-peer settlements with no intermediaries required so that individuals could keep control over their assets. However, Bitcoin and early cryptocurrencies only decentralized the issuance and storage of money, not access to a broader set of financial instruments.

The infographic below describes a simplistic example of how the ideal decentralized exchange would occur compared to the status quo.

Source: Defi Pubs

Decentralized Finance (DeFi) – the unlikely hero?

On paper, Decentralized Finance (DeFi) is disruption defined, allowing individuals full control and access over their assets. DeFi is an umbrella term referring to all the financial applications, such as lending, borrowing, exchanging, and investing which occur through decentralized channels and exchanges. The idea is to create an open-source, permissionless, and transparent financial service ecosystem available to everyone via peer-to-peer (P2P) capability, operating without any central authority. DeFi is distinct because it expands the use of blockchain from simple value transfer to more complex financial use cases such as borrowing, insurance etc. The activity in DeFi has increased exponentially in 2020 with total value locked in increasing from $1 Billion to $10 Billion in a span of 4 months.

Source: Defi Pulse

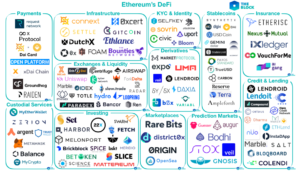

As mentioned previously, DeFi is primarily being used for loans, trading and payments but there are additional use cases such as insurance and investing being developed. The Ethereum blockchain eco-system is the most popular for the development of these applications since it provides increased security, transparency, and growth opportunities. The Ethereum platform functions through ‘smart contracts’ which automatically executes transactions if certain conditions are met, removing the human element from all transactions.

Source: Block Crypto

While more and more people are being drawn to these DeFi applications, it’s hard to say where they’ll go. Much of that depends on who finds them useful and why. Many believe various DeFi projects have the potential to become the next Robinhood (popular online brokerage that enables stock trading at very low fees), drawing in hordes of new users by making financial applications more inclusive and open to those who don’t traditionally have access to such platforms.

DeFi’s not so shining armor

As with any new technology, there are growing pains. Some of the ones hurting DeFi particularly have been highlighted below:

1. Incomplete decentralization - Although protocols are decentralized and based on consensus algorithms, many access points to the system, like exchanges, are still centralized. In addition, many crypto projects are managed through centralized organizations or companies that too often lack transparency or accountability, and do not openly show the development of new parts of the ecosystem.

2. Volatility - Many DeFi applications, such as meme coin YAM, have crashed and burned, sending the market capitalization from $60 million to $0 in 35 minutes. Other DeFi projects, including Hotdog and Pizza, faced the same fate, and many investors lost a lot of money.

3. Security – While there are no humans involved in the smart contract process, humans do create the contracts and that is a major source of errors. Smart contracts are powerful, but they can’t be changed once the rules are baked into the protocol, which often makes bugs permanent and increases risk.

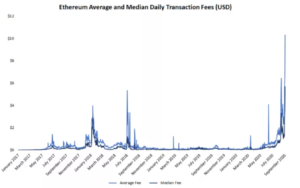

4. Rising Network fees – Network usage is directly correlated with fees and due to the recent popularity of DeFi, the Ethereum fees have sky-rocketed. This has led to a decrease in profitability for DeFi users and is hindering user experience.

Source: Coindesk

5. Risk of Fraud – While smart contracts have no human involvement in its execution, there are humans involved in its coding. This vulnerability leaves the door open for errors and subsequent attacks on the network.

Conclusion

Decentralized Finance is still at its nascent stage and is still trying to find solid ground beneath its legs. Blockchain and cryptocurrency enthusiasts seem to think there is enormous potential and have therefore poured significant sums of money into various DeFi platforms. Given the multiple challenges DeFi currently faces, worse comes to worst, it will at least force the centralized system to become more competitive by introducing changes to their structure.

en

en  pl

pl